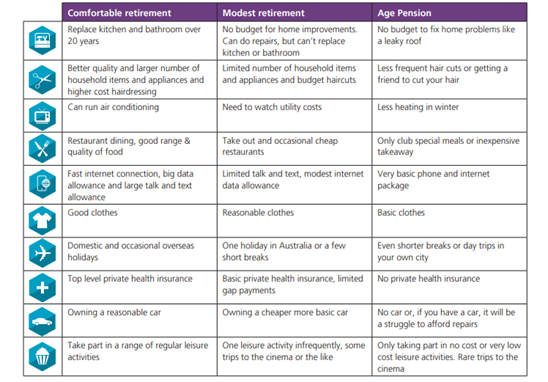

Table Source: here

Now your first step is working out where you sit currently / how you are tracking re your super. To do that you need to go to the Money Smart Website and have a play around with the calculators based on your situation and where you want to be in your retirement years.

In a nutshell unless you are on big bikkies at work you are going to have to come up with additional ways to grow your wealth.

Savings is underrated, but it is the easiest way to grow your wealth. How it works is you spend less then you earn. If you find you cannot save, that just means you either need to spend less or earn more. Pretty basic right? Problem is with all that’s going on in our daily lives most of us struggle to plan 3 months in advance let alone 30 years.

Top Tip: Automate your savings – set up a direct debit where your money goes into an account you don’t view often or if you are trying to pay down your principal place of resident it goes straight onto the home loan. You want to take the human element out, let the machines do the hard work.

Shares are a good option, the barrier to entry is low. What I mean by that is you can start investing with as little as $500 dollars. All you need to do is set up a trading account with your bank and away you go. Great thing about shares are that they are liquid, which means if you need to sell, you can

sell and get your money out within 3 days. Shares can be volatile so sometimes quick wins and short term investing can be quite daunting and feel a little like gambling. You will need to be a little brave and super disciplined so you can start to try and trade which means you buy and sell. It can start to feel a bit like gambling, especially if you have some early wins. However bear in mind it can be a little tricky in getting started and chances are you will lose some gains when the market starts to fall.

Next up is property, my favorite. Firstly, buying land and building a house as an investment is a lot of work and patience! You have to research the area, find the right estate, the right block, the right builder, you need a broker, conveyancer and in some cases you might have to wait 12-24 months for your land to be built, titled and your house to then be constructed.

I have built three houses so far in my property journey with another under construction. We sold our first one this year for a gross profit of $140,000. We held this property for 2 years - I would never be able to save that kind of money in a two-year period. So why did it go up so much in such a short period of time? We chose an area the was reasonably new. The great thing about the location was there were plans for shops and schools with locked in funding and construction due to commence. Now why did we sell this property, it was positive which means that rental income was greater than the interest payments on the loan, so we were not getting any tax benefits and we needed the cash to purchase another property.

Top Tip: The only reason you sell an investment property is to fund the purchase of another property, you do not sell it to put a pool in. This does not get you ahead – it gets you back to square one with a pool.

So, what pearls of wisdom can I provide:

- Look for locations with significant population growth, if you google a specific suburb & population growth at the same time it will normally take you to a council website which will give you the stats. It is a simple supply and demand situation. You want more people moving in than houses are being built.

- Look for the longest possible title timeframe, its going to give you time to save as well as buying the land at today’s price, but you settle on the land 12-18 months down the track. In my experience if you have picked the right area the same sized lot in the same area will be being sold for a higher price.

- Ideally try and negotiate the lowest amount of deposit e.g 5%, you will then be using the equity in your principal place of residence to cross secure the property. This gets your around LMI. (lenders mortgage insurance)

- Go onto Realestate.com or speak to the local real estate agent in the area your are looking to buy and confirm these things: what is the scarcest type of rental property. It might be small lots with 3 bedroom homes. Do not be a sheep, if everyone is building 4-bedroom homes it does not mean you need to.

- Lastly you want to work out what you think your rent return would be and your yield. Let’s say your total cost of the property will be $500,000 and this property would rent for $440 per week. To get the yield you: ($440/7days=$62.85x365days=$22,942/$500,000=0.045884x100=4.58) anything above 4% is good, the higher it is the more chance your property would either neutrally geared or positive.

- Now if you fancy a location that does not offer untitled land, then that is fine. If the numbers stack up and the long-term growth potential is positive, then move forward. It is a buyers’ market now, and you would be surprised at the type of deals on offer.

Author: Ben Stewart - Core Projects.